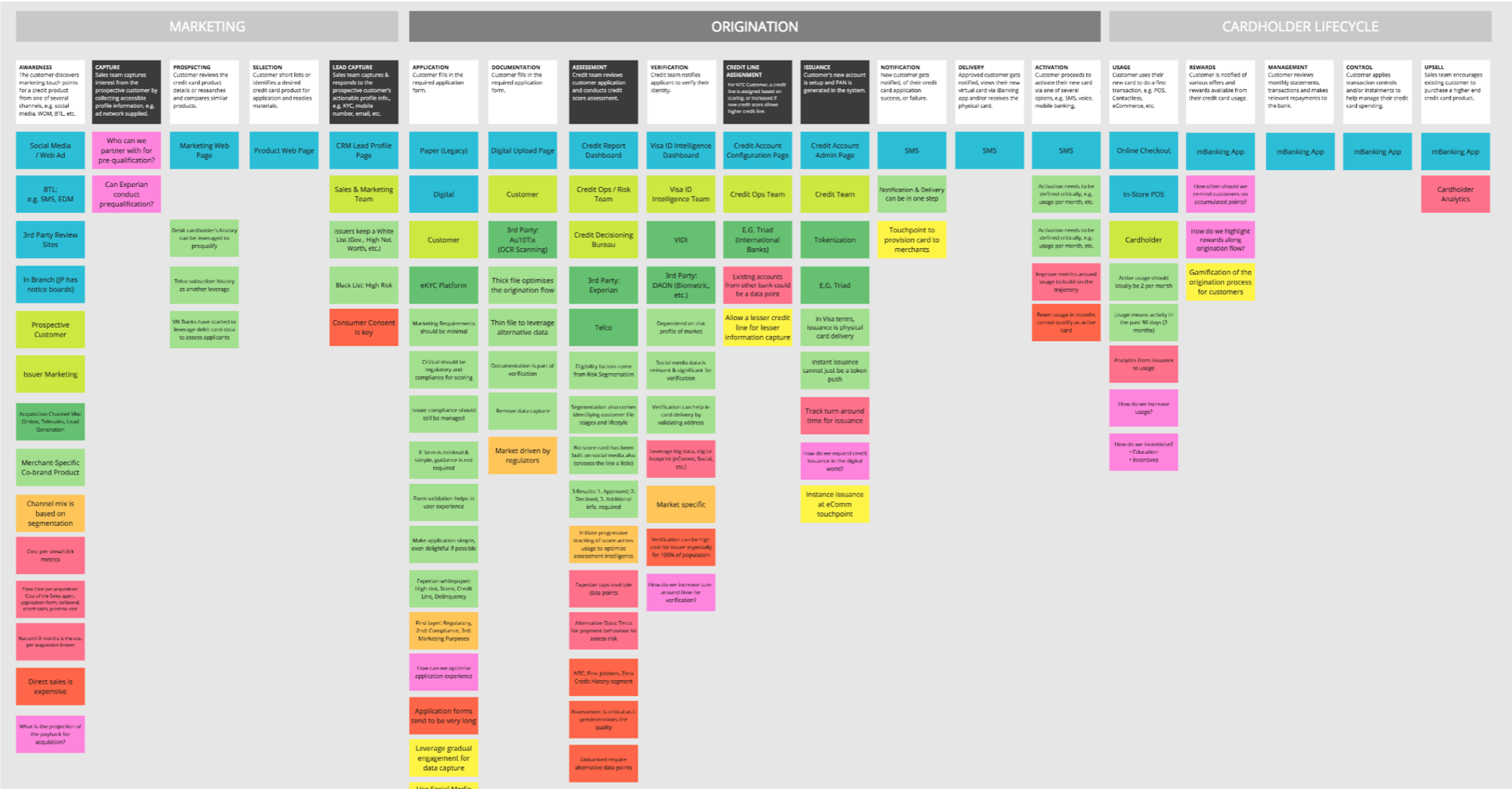

Credit service blueprint

Service Blueprint mapping the end-to-end stages of credit card onboarding, issuance, and lifecycle

BacKGROUND

The credit issuance lifecycle requires an ecosystem of services working together to process prospective bank customers from lead generation to credit score assessment all the way to the delivery of the plastic credit card. Issuers typically have to navigate through 3rd party services which may only serve the typical customer profile, i.e. thick-file bank customers. And while various digital service providers exist now to capture the thin-file and new-to-bank segment, banks in emerging markets are still in the dark on where to look and whom to partner with in order to accelerate approval rates and grow their credit customer user base.

With Visa’s extensive experience in delivering digital solutions across multiple markets, there is an opportunity to provide a singular services platform for credit issuance in AP‘s emerging markets as well as introduce new capabilities for more sophisticated issuers.

OPPORTUNITY

ROLE

As the Service Blueprint Facilitator, I designed the workshop and prepared with the primary Product Owner to define the stages of the service flow and identify who might the participants be. I was also responsible for producing a report of the output, which included digitising the blueprint for documentation as reference in the development of the solution proposal.

Credit Service stakeholder Steven, as product owner of the initiative, explains some of the considerations of the ecosystem as I capture them initially as notes on the whiteboard, and later assigned to their relevant post-it colour tag.

APPROACH

To identify the opportunities and where best we could deliver value to issuers along the credit service lifecycle, we needed to survey the breadth and mine the depths of the credit issuance ecosystem.

This objective required mapping the various components of the credit service lifecycle in order to identify the opportunities and address gaps if any. To accomplish this, we undertook a Service Blueprint approach to unpack the end-to-end and surface-to-core components of the credit service ecosystem.

WHY BLUEPRINTING?

To manage expectations from the 5 participants, I provided the following rationale in the collaboration space we reserved for the blueprint workshop.

- Identifies process breakdowns and opportunities for process improvements

- Informs the implementation plan for a new service

- Audits service metrics in the context of service delivery

- Defines a vision for how a service or touch point can be elevated or relegated

Objectives

Through the blueprint mapping sessions and the group review, we aimed to:

- Outline the end-to-end, surface-to-core components and identify the critical steps along the credit service flow

- Highlight insights at key stages

- Identify strategic points and tactical fixes if required

- Define the strategic action steps from the insights at key areas highlighted

Input from the participants were captured using the Practical Service Design Blueprint framework with its colour-coded cards

PROCESS

1:1 SESSIONS

I applied the service design framework, Practical Service Design, to structure the exercise and arranged one-on-one sessions with stakeholders to capture individual perspectives.

Input was classified based on the following set of service blueprint aspects and colour coded as shown above.

REGROUP

Once all input was captured and digitized, participants then convened as a group to review and highlight the salient points, capture opportunities, and plan for the next steps.

All input were digitised using RealTime Board as the electronic version of the Service Blueprint and highlighting the middle Origination flow as the problem space. In one of the 1:1 sessions, the stakeholder was actually remote and the electronic version proved invaluable as we conducted the session over the phone and reviewed the same online digital whiteboard to anchor our discussions.

INSIGHTS

The following were the summaries of insights for each staged that I synthesised and subject to validation in the regroup session.

PRE-APPLICATION

Pre-Application involves Marketing-related activities from Customer Awareness to Lead Generation but was relevant for the opportunities to prequalify prospective customers.

Can the platform leverage the acquisition channels to prequalify and further target by segment? How might we leverage analytics as a tool to evaluate total cost per acquisition?

ORIGINATION

The team identified the key components and 3rd party services necessary in this pivotal juncture of the credit issuance lifecycle.

How can we reduce the friction during Application and accelerate the turnaround time for verification and approval? With whom might we partner to innovate on new approaches for risk scoring?

POST-ISSUANCE

Stakeholders identified opportunities to connect Rewards to the Origination process for mutual benefit.

How might we leverage Rewards from the Application step all the way to Issuance to incentivize prospective customers?

REGROUP DISCUSSIONS

In the group session, stakeholders raised these points on the need for a one-stop credit services platform for issuers.

BENEFITS TO CLIENT

BENEFITS TO VISA

IDEAS

The service blueprint exercise enabled ideas to surface and the following were captured in both the 1:1 as well as in the regroup discussion. These ideas are notable for their relevance in future conversations and design hackathons with clients.

QUESTIONS

The regroup was also a good opportunity for stakeholders to raise questions for the vision and aims of the credit service platform. Captured below are the questions that will benefit the next stage.

- From a capabilities and integrated services offering perspective, what do we have today? Where are the gaps? What can we leverage?

- Are we merely providing a dashboard view from 3rd party services or are we returning a singular Visa credit risk score from the aggregated capabilities both internal and from partners?

- What might be our tactical approach in delivering a solution in the short to medium term (3-6 months) particularly in emerging markets?

NEXT STEPS

In the course of the discussions, the team identified these opportunities to pursue and areas to explore as next steps.

USE CASE DEFINITION

Formulate two use cases: (1.) Issuer credit service engagement in an emerging market; (2.) mature market application of key credit business services.

Reference and track progress of in-market design sprints, such as the recent RCBC Credit Issuance in the PH market partnering with Lenddo.

CONNECT WITH VDP

- Synch with concurrent programs in VDP to leverage pilot testing of new platforms such as VIDI.

- Leverage VDP’s Digital Issuance setplay and its related materials as a component.

SUMMARY

The Credit Service blueprint workshop and sessions enabled stakeholders to frame Steven’s concept and vision by going wide and deep, revealing process components that are integral and critical to the ecosystem.

It also functioned as a forum to raise questions, identify opportunities and gaps, and capture ideas. Participants have echoed the value of the exercise for allowing a panoramic view but have emphasized the need to act on a plan toward defining a viable and feasible credit service solution for the region.